For many, realizing the costs of probate motivates them to prepare an estate plan. An attorney’s probate fee is collected from the estate itself and is based on the size of the estate. However, in California, the estate is measured by gross value, not net value. This means the estate’s value ignores encumbrances or other obligation on assets of the estate. For example, if a house is the only asset of the estate and is valued at $600,000, with $300,000 left on the mortgage, the attorney’s probate fee will be based on the $600,000, ignoring the mortgage.

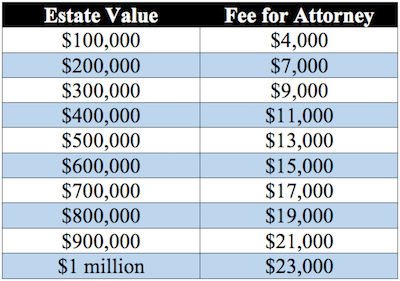

Under California’s Probate Code section 10810, fees for “ordinary services” of an attorney are as follows:

It is important to remember: these fees are a minimum, as they are just for ordinary services. There may be additional “extraordinary services” the attorney performs and seeks compensation for.

Probate is also a fairly public process that takes place in a courtroom with a judge interpreting the law in order to determine where the property of the decedent (dead person) will go. The judge will not know what the decedent intended. None of the decedent’s wishes can be considered because there is no estate plan.

Having an estate plan can help you avoid probate. An estate plan puts you in control of what will happen to your assets after you pass away. Typically a plan can be created for a fraction of the costs of probate. Given changes under the American Taxpayer Relief Act of 2012, now is a great time to consider or reconsider your plan.