On Wednesday, May 18, 2016 the U.S. Department of Labor (the “DoL”) issued its final regulations changing the salary test for exemption from overtime under the Fair Labor Standards Act. The DoL’s discussion of the new regulations is found here for private employers. California employers need to familiarize themselves with these changes to avoid costly wage and hour class action lawsuits.

All California employers are subject to minimum wage requirements under both the California IWC Orders and the federal Fair Labor Standards Act and must pay the higher minimum wage. Likewise, private employers are subject to overtime requirements under both State and federal law, and must pay whichever is higher. However, public agencies are not subject to California’s overtime requirements, and must meet only the federal requirements for exemptions from overtime.

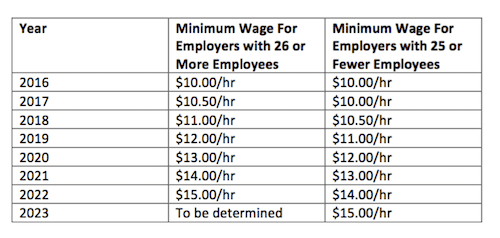

For many years, California has had the higher minimum wage, which is applicable to both public and private employers. Under recently signed legislation, the California minimum wage will increase each of the next six years as follows:

Table 1 – California Minimum Wage Under SB 3

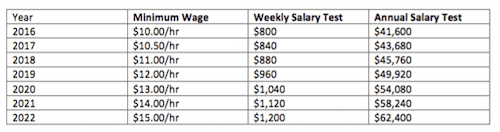

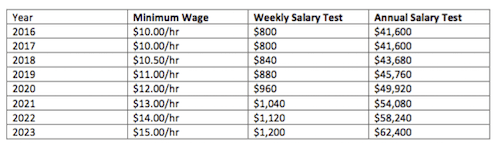

To be exempt from overtime, employees must meet both the salary and duties tests under applicable law. The orders of the California Industrial Welfare Commission, found here, set the California salary test at twice the minimum wage for a 40 hour work week. The following table shows how SB 3 will affect the California salary test for private employer. Public employers are not subject to California overtime law.

Table 2 – Increases in the California Salary Test Resulting From SB 3 – For Employers with 26 Or More Employees

Table 3 – Increases in the California Salary Test Resulting From SB 3 – For Employers with 25 Or Fewer Employees

The New Federal Salary Test for Exemption from Overtime

The federal salary test is set without regard to the minimum wage and is currently far lower than the California salary test. The DoL has two salary tests – one with the full duties test, and one for highly compensated employees with a relaxed duties test. Before the new regulations take effect, the basic federal salary test is only $455/wk or $23,600/yr and the salary test for highly compensated employees is $100,000/year. At present both of these federal salary tests are relevant only to public employers who are not subject to the California overtime rules. For private employers, California law has provided a higher salary test than federal regulations, and California offers no relaxed duties test for higher salaried employees.

However, starting on December 1, 2016 both private employers as well as public employers will have to adapt to the new federal regulations on the salary test. The DoL just issued regulations increasing the minimum salary test to $913/week or $47,476/yr, effective December 1, 2016. For the highly compensated employee exemption, the salary test is raised to $134,000/yr. In addition, the DoL has also set up a mechanism to review and increase the salary test every three years.

Effect: This change may hit public employers especially hard, because they have operated under the very low FLSA salary test without regard California overtime law. Public employers should review their employee rosters to see which salaried employees make less than $913/wk. For those employees, there are several possibilities: (1) reclassify them as non-exempt, start keeping hours records and paying overtime; (2) increase their pay above $913/wk; (3) keep hours records and pay both the current salary (below the new federal standard) as well as overtime for all hour in excess of 40 hours per week.

Starting on December 1, 2016 private employers will also need to meet the new federal salary test. That salary test will be higher than California’s salary test until January 1, 2019, when California’s salary test for larger employers will rise to $960 per week. Like public employers, private employers must review their payrolls to see which currently salaried employees earn less than $913/week. In those cases, private employers will have to either raise the salary, or commence paying overtime.

California law applicable only to private employers imposes an overwhelming variety of damages and penalties on employers who classify employees as exempt when the employees fail to meet either the salary or the duties test. This review should commence well before December 1, 2016.